Key Points:

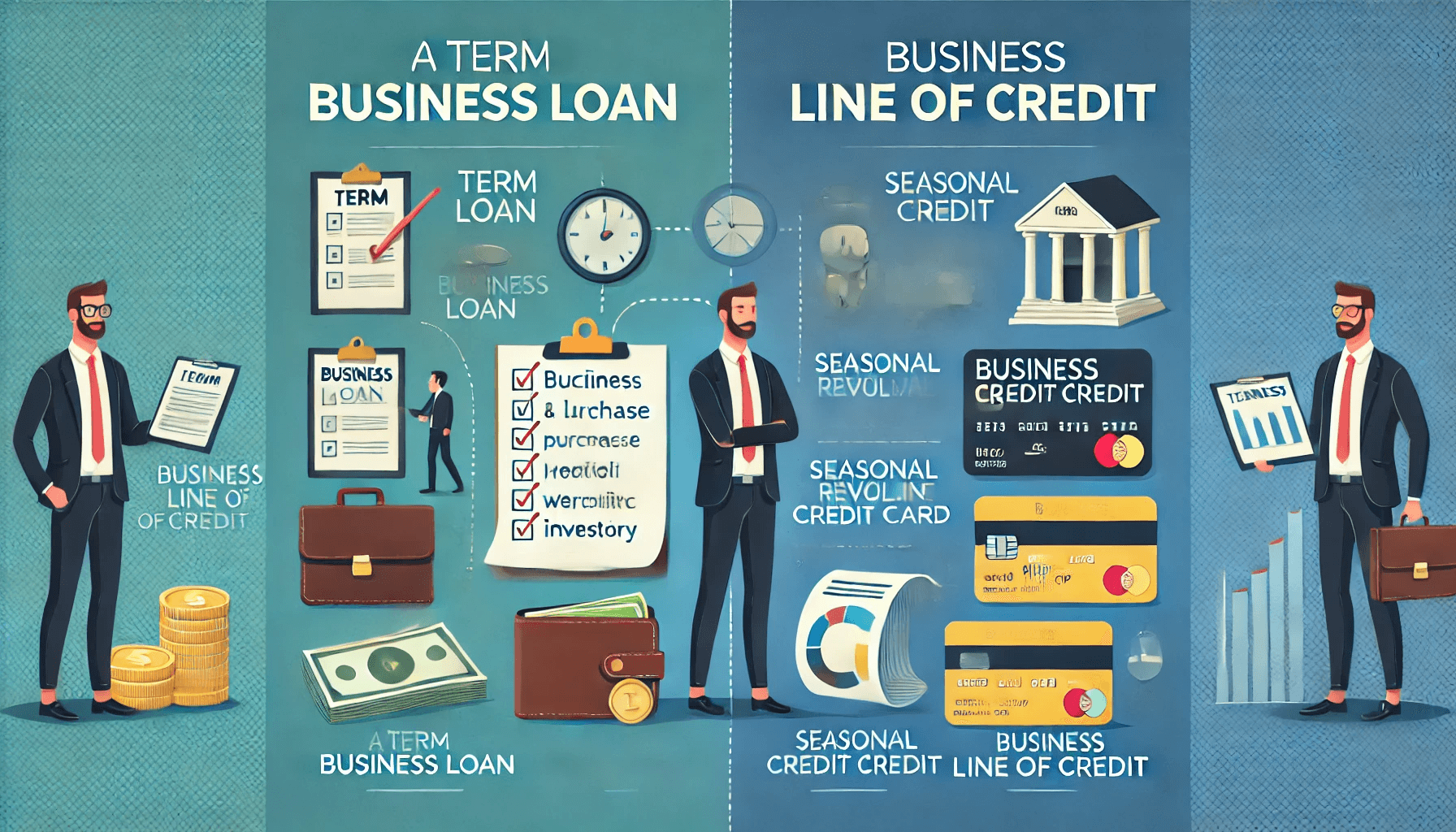

- The purpose of term loans are for large, one-time expenses; lines of credit are for short-term, flexible needs.

- Term loans have fixed rates and structured repayments; lines of credit have variable rates and flexible borrowing.

- A business line of credit is that it offers flexible access to funds for managing short-term or unexpected expenses, allowing businesses to borrow only what they need and pay interest only on the amount used.

Understanding Term Business Loans

A term business loan is a traditional financing option where a business borrows a lump sum of money and repays it over a specified period with interest. These loans are ideal for businesses that need a significant amount of capital for large, one-time expenses such as purchasing equipment, real estate, or funding expansion projects. The structured repayment schedule helps businesses manage their cash flow effectively, but it requires a strong credit history and solid financials to qualify for favorable terms.Exploring Business Lines of Credit

A business line of credit, on the other hand, provides more flexibility. It works like a credit card, allowing businesses to borrow up to a certain limit and only pay interest on the amount borrowed. This revolving credit option is ideal for managing short-term expenses, such as inventory purchases or covering seasonal fluctuations in cash flow. Businesses can draw and repay funds as needed, offering a cushion for unexpected expenses. However, lines of credit usually have variable interest rates and require careful management to avoid high-interest costs.Key Differences Between Term Loans and Lines of Credit

When deciding between a term business loan and a business line of credit, it is essential to understand the key differences:- Repayment Structure: Term loans have fixed repayment schedules, while lines of credit offer more flexible repayment options.

- Purpose: Term loans are suited for large, one-time expenses, whereas lines of credit are better for ongoing, short-term needs.

- Interest Rates: Term loans typically have fixed interest rates, providing predictability, whereas lines of credit often have variable rates, which can fluctuate.

- Qualification Requirements: Term loans usually require a strong credit history and financials, while lines of credit may have more lenient requirements but higher scrutiny on usage and repayment behavior.

When to Choose a Term Business Loan

Choosing a term business loan is beneficial when:- You need a large sum of money for a specific purpose, such as purchasing equipment or real estate.

- Your business has a predictable cash flow that can accommodate regular repayments.

- You prefer the stability of fixed interest rates and structured repayments.

- You have a strong credit history and can qualify for favorable loan terms.

When to Opt for a Business Line of Credit

A business line of credit is the better choice when:- Your business requires flexibility to manage short-term or unexpected expenses.

- You prefer to borrow only the amount needed and pay interest solely on the borrowed funds.

- Your business experiences seasonal cash flow fluctuations and needs a financial cushion.

- You have the discipline to manage variable interest rates and maintain the line of credit responsibly.